NFT ecosystem growth during the bear market

Are NFTs dead?

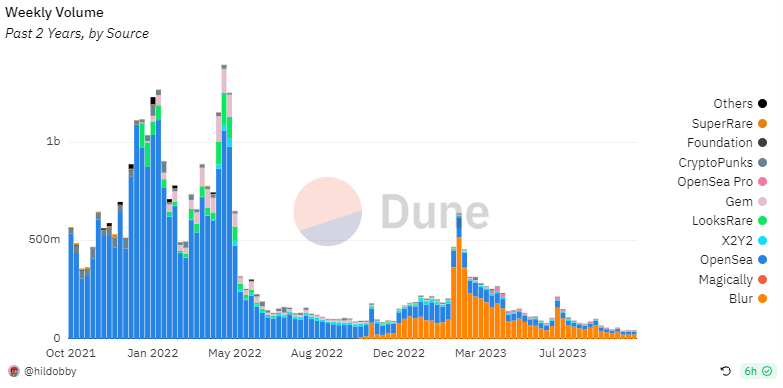

It’s been a rough period for the NFT industry that once drove the crypto bull run. NFT’s weekly trading volume dwindled from $1.4B to $45M, Yuga Labs is laying off people in light of decreasing revenue and needing to re-focus ..

However, events and metrics focused on PFP NFTs, which had been the star of the show, may be a misleading indicator of what will become of the NFT market. Contrary to what may seem on the surface, the movements on the ground tell us that the NFT ecosystem is going through a step change towards a lasting future — both in what NFTs mean and the financial infrastructures that will expand the NFT-based economy.

Diversification of NFT as an asset class

NFTs, in their essence, are various objects or assets that are non-fungible in nature, represented as tokens. This means that many different things can be NFTs, not just PFPs. At NFTBank, we’ve always been looking forward to the time when this essence is realized because only then, will there be a lot more data-driven opportunities to expand the NFT-based economies.

We’re slowly seeing that this time is on its way; after the season of “apeing”, more people are interested in leveraging NFTs as a technology to represent more utility-based assets and/or assets with proven value.

As discussed previously, RWAs represent a big part of such NFTs. In addition to USDC & US T-Bills covered in our article, a few notable types include:

- Physical assets: Works from the likes of 4K Protocol are bringing physical assets, such as Rolex and even T-shirts on chain as NFTs

- Real Estate: Whether actual buildings or mortgages, there have been continuous efforts to leverage NFTs in capturing the real estate market on chain

Utility-driven NFTs actually go beyond RWAs. Namely:

- Music: (perhaps considered as RWAs) Songs, not just those of rising artists, but those of megastars such as Justin Bieber, are being turned into NFTs, which allow fans to invest in the future royalty streams of those songs.

- Cashflows: similar to music royalty streams, on-chain streams — be it payroll, airdrop, payroll, or grants — are captured as NFTs (kudos to the team at Sablier), and even integrated with lending protocols such as NFTfi

- In-Game Assets: With web3 gaming being one of the few well-funded sectors in this bear market, there’s a lot of building underneath the surface in web3 gaming. Though there are varying opinions on the extent to which the games should be fully on-chain, there’s a general consensus that NFTs are a good fit for in-game assets. With the sovereignty enabled when in-game assets become NFTs, the propensity to spend and drive the capital economy in games will increase, so many are optimistic.

By no means, is this a complete list, and to be exact, these NFTs have existed for some time. However, the lessons from the first NFT run have sparked stronger interest and further development around these various types of NFTs that are known to have more inherent or proven value. What we see today captures the true nature of NFTs better and the build is quietly happening in the midst of the bear market.

Financial infra for NFTs

The past NFT bull market has also left the preliminary development of a financial infra that allows NFTs to be leveraged as an asset class at scale. Let’s put ourselves in the shoes of an NFT fund as a way to make the matter more concrete.

While individual retail investors can be an important part of market growth, larger liquidity comes through funds. They further expand the opportunities associated with the asset by their ability to engage in more sophisticated dealing of the assets. The NFT bull run has given rise to NFT funds as an increasing number of people sought exposure to the esoteric asset.

For these funds to operate, a number of different systems needed to be in place. At the most basic level..

- Custodial Solutions: Without custody, there can be no funds. Players such as Bitgo & Fireblocks have expanded their support to include NFTs, and institutional wallets (which connect funds to different custodial solutions) like Metamask Institutional, also support NFTs now

- Fund Admins: Working closely with the funds are fund admins to manage a lot of the operational matters. Notable Fund Admins who’ve been serving NFT funds include NAV Consulting, Formidium (formerly known as Sudrania), and others.

- Tax & Audit Services: Accounting firms (Big 4 as well as boutiques such as Marcum) are frequently spotted speaking or holding booths at crypto conferences, as they offer services to some of the largest crypto funds. Getting deeper into the ecosystem, they follow the market and closely engage with not just FT infrastructures, but also with teams building around NFTs.

- Asset Valuation: Asset valuation is a critical component for LP reporting and NAV calculation. NFTBank has been privileged to be trusted by and serve NFT funds, and work with accounting partners to deliver the most reliable asset information to assess the fair value.

Furthermore, there are also infrastructural developments that allow funds to better control risks while getting exposure to NFTs. This, in turn, allows more capital to flow in.

- Lending protocols: the advent of NFT-backed lending protocols definitely extended the market during the hay days. It continues to support the ecosystem growth as new forms of NFTs emerge. For example, Arcade.xyz has been facilitating loans on Rolex NFTs & T-shirt NFTs mentioned above and NFTfi on on-chain streams in partnership with Sablier.

- Secondary market: the availability of secondary markets, especially those that are tranched, further expands the market as it gives the originator of NFTs or NFT-backed loans a way to more reliably liquidate their holdings, as well as gives way for investors to access exposure with specific risk parameters. Metastreet is a team that’s been leading the way in this space.

Surely, these systems will need to evolve along with the NFTs. Still, their hands-on exposure to handling NFTs, which are much more complicated than FTs, can serve as a foundation to quickly follow the development and help expedite the market growth when the time is ripe. The competitive edge of these players is non-neglectable.

Builders keep building

While no industry-wide craze exists around NFTs anymore, not all was lost. The remnants of the bull run are pushing the evolution that will manifest the full potential of NFTs and grow a more stable ecosystem around it.

We’re excited for this future. Are you a builder looking to unlock new forms of NFTs with real value? Are you an NFT fund seeking ways to operate your fund with less headache? We’d love to connect and help.

Let’s bring our heads together to shape the future together. You can find us on Discord, Twitter or via email (contact@nftbank.ai).

About NFTBank

Backed by the top investors in the scene, NFTBank has been developing the most accurate and comprehensive data sets that help the Web3 community understand individual NFTs. Whether it’s the broader market data (e.g., Floor Price, Trait Floor Price, Sales volume, Sales price distribution) or individual NFT-specific data (e.g., NFTBank Price Estimate, Metadata, Acquisition Price), many dApps and NFT finance protocols trust NFTBank for the most reliable NFT data and expertise.

NFT ecosystem growth during the bear market was originally published in NFTBank.ai on Medium, where people are continuing the conversation by highlighting and responding to this story.